The $100 Million Opportunity: Why I’m Buying Self Storage Again (and Why You Should Too)

Hey there,

Fifteen years ago, I made a bet that changed everything for me. It was 2008. The real estate world was collapsing, fear was rampant, and “wait and see” was the default strategy for most investors. But while everyone else was paralyzed, I went all in on self storage.

Those decisions built the foundation for what eventually became a portfolio worth hundreds of millions of dollars.

And here’s the thing: it’s happening again.

It’s not every decade you see a once-in-a-lifetime opportunity repeat itself.

The same market forces, the same dislocation between price and intrinsic value, and the same fear-driven hesitation that keeps most people out of the game. Except now, we know exactly what to do, because we’ve seen this movie before.

Today, I want to walk you through why this moment is so rare, what’s driving it, and how I’m positioning myself to capitalize on it once again.

Looking Back: The Last Time We Saw This Kind of Opportunity

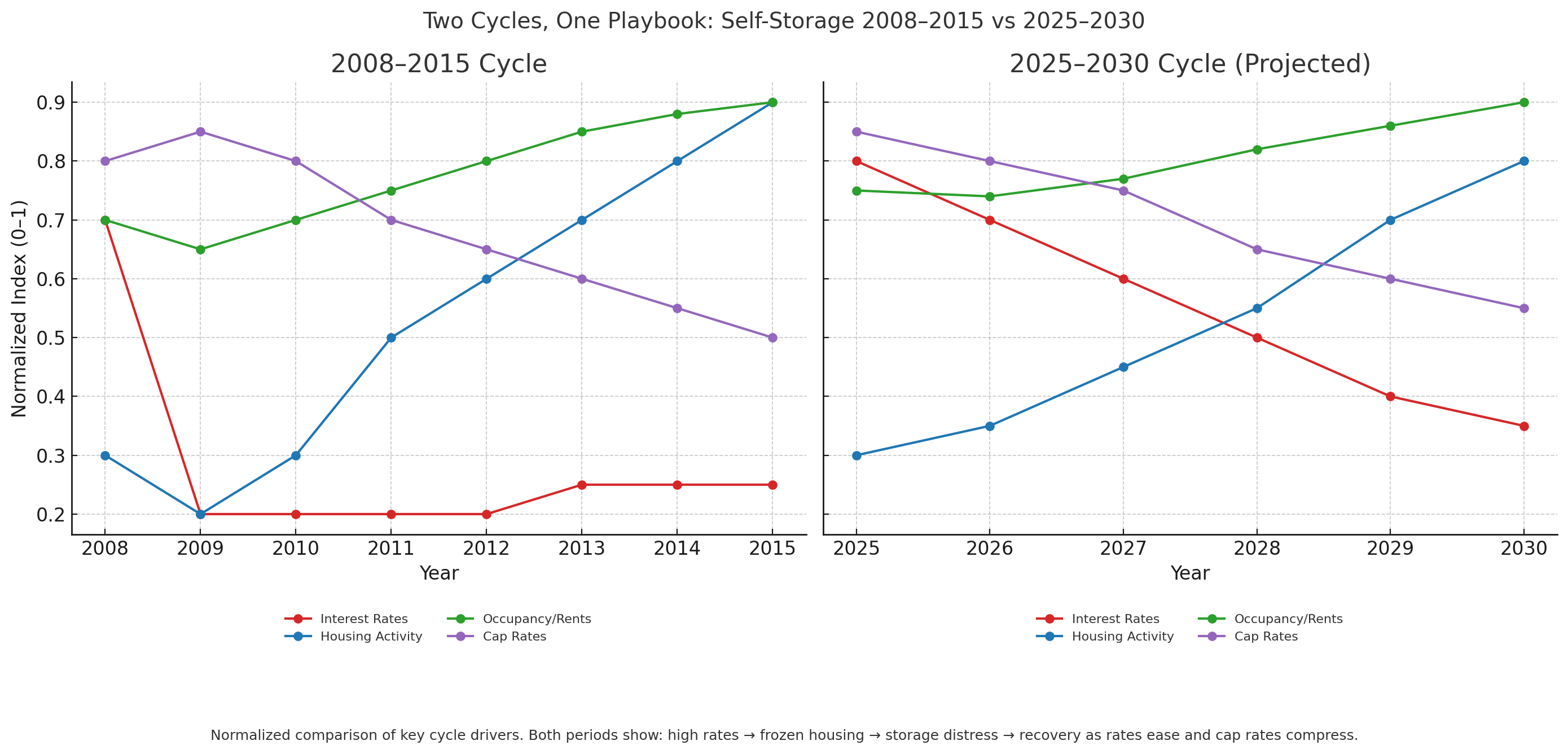

After the 2008 crash, the world looked bleak. Prices had cratered, lenders were frozen, and everyone was predicting a “lost decade.” But I noticed something that changed my life:

The drop in prices wasn’t because storage assets had lost their intrinsic value - or their ability to generate income. It was because of external forces. Fear, liquidity issues, and macroeconomic panic had driven prices below replacement cost.

So we started buying.

We were one of the few still bidding on assets in markets where nobody else showed up. Everyone told us we were crazy. At the time, it didn’t look like the economy would bounce back anytime soon. We figured it might take ten years or more just to recover.

But instead, what followed was one of the greatest wealth creation runs of our lifetime.

We focused on fundamentals - good locations, solid operations, and facilities where we could improve revenue. We bought assets that were undervalued not just by market conditions, but by management inefficiencies.

And when revenue went up, and the market recovered, the value of those assets exploded. We refinanced, pulled out our cash and profits, and still owned the properties. Then, as the market matured, we exited at record valuations.

That playbook, grounded in fundamentals and disciplined buying, became the blueprint for everything we’ve done since.

Fast Forward to Now: Déjà Vu in Self Storage

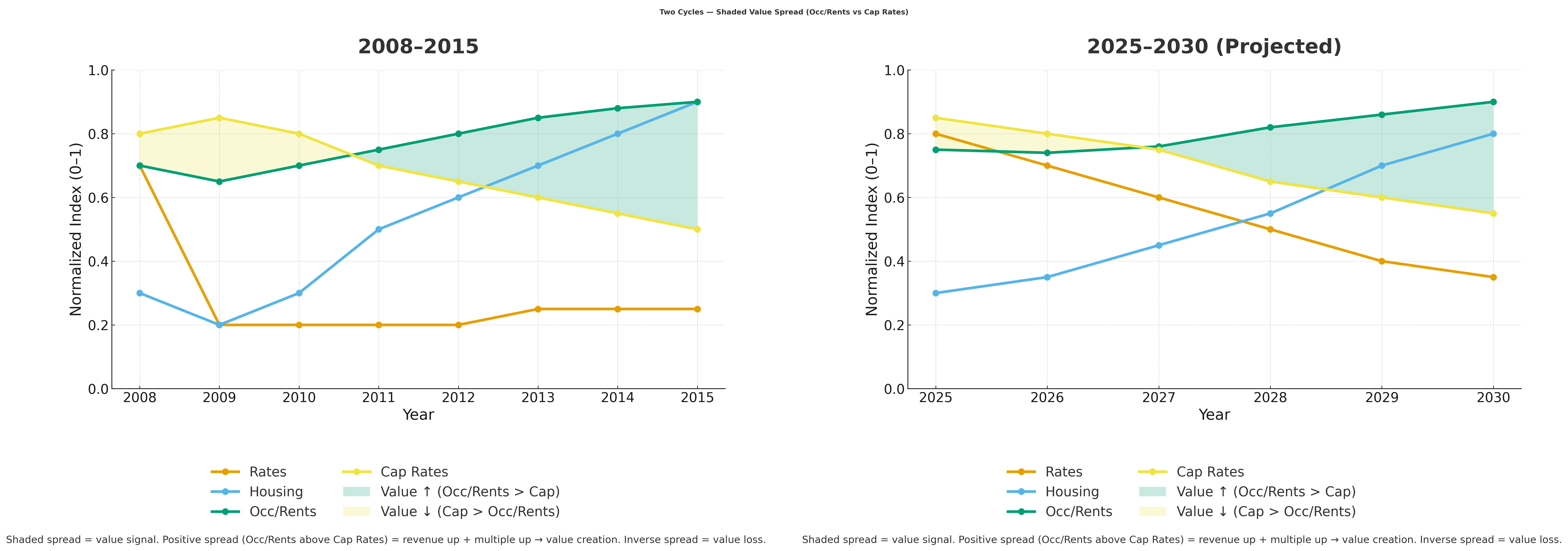

Over the last three years, the self storage industry has quietly entered a recession.

Rising interest rates crushed values. Development costs stayed high while demand softened. Occupancy dropped as housing activity froze.

Sound familiar? It should. It’s nearly identical to 2008–2010.

Let’s unpack what’s happening:

-

Interest rates skyrocketed. When financing costs rise, buyers can’t pay the same prices, which drives cap rates up and values down.

-

The housing market froze. People stopped moving because mortgage payments doubled. Moves drive storage rentals - so when people stay put, occupancy falls.

-

Development collapsed. Banks stopped lending, construction costs didn’t fall, and many developers are stuck mid-project or exiting at a loss.

-

Revenues dropped, but costs didn’t. Rents softened to attract tenants, while insurance, taxes, and labor costs all stayed elevated.

This combination hit storage harder than any other real estate asset class. And that’s exactly why I’m so excited.

When Everyone’s Running Away, We’re Running In

Right now, we’re buying well below replacement cost in major markets like Texas, Iowa, and across the southeast.

Here’s what that means in practice:

We’re picking up facilities that cost $160 per square foot to build, for $100 per square foot or less.

We just bought an 80,000-square-foot property that was built for around $7 million three years ago for $4 million.

Let that sink in.

We’re essentially traveling back in time to 2015 pricing - but with assets that are newer, better located, and in stronger markets.

This isn’t just about buying cheap. It’s about buying intrinsic value at a discount.

Even with soft rents and lower occupancies, these properties produce strong cash flow. And as interest rates ease - even modestly - we’ll see a direct lift in revenue and valuations.

How do I know? Because we’ve already tested it.

What the Data Tells Us

Over the past year, my team and I analyzed over 1 million square feet of storage data across multiple states.

We intentionally stopped marketing for a period so we could watch what the market was doing, not what our ad spend was influencing.

What we found was remarkable:

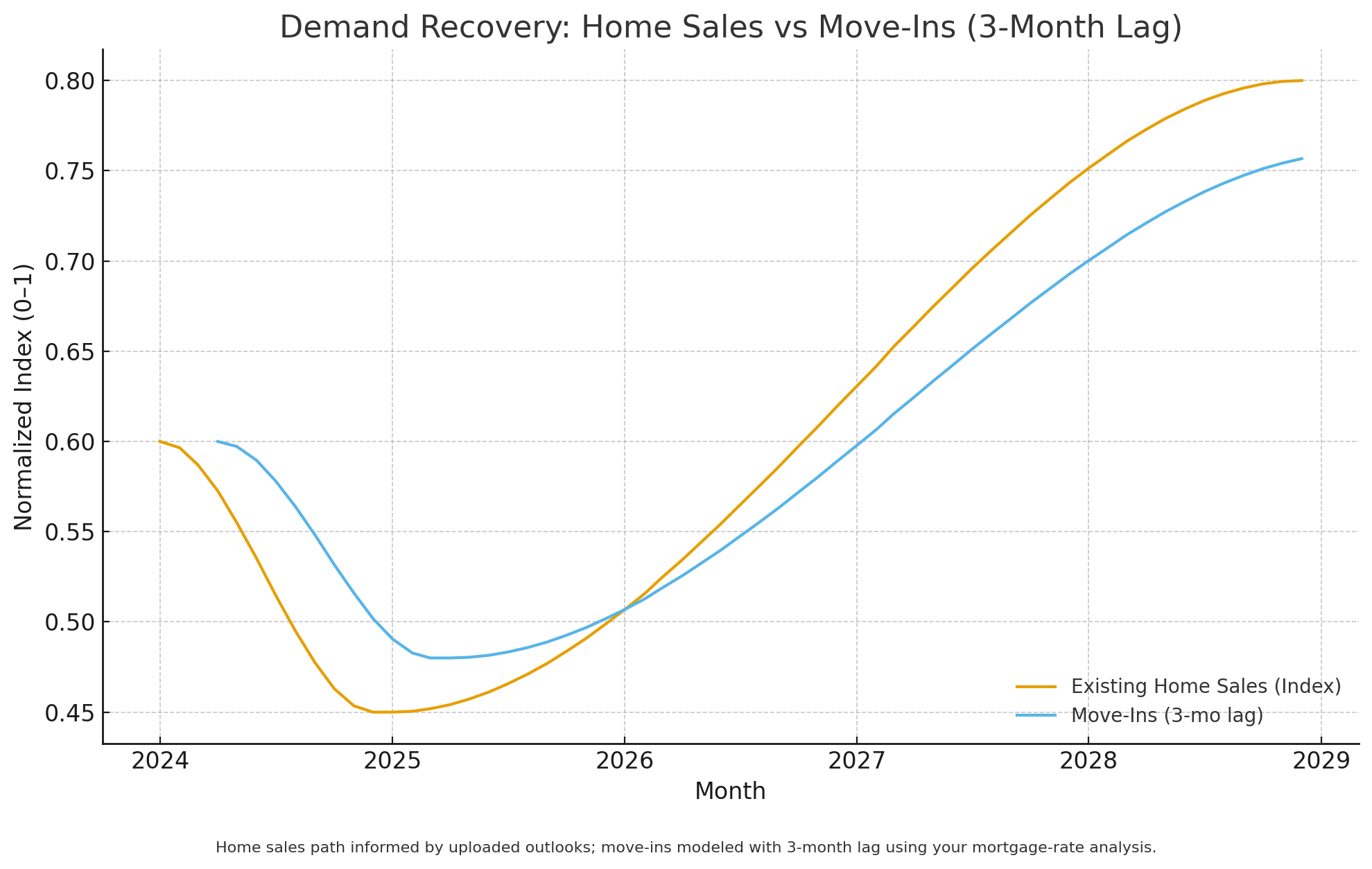

There’s a 95% correlation between mortgage rates and storage move-ins, with a three-month lag.

Every 10-basis-point drop in the 30-year mortgage rate produced a measurable uptick in storage move-ins within 90 days.

That means when rates move from 6.8% to 6.6%, demand for storage spikes.

When they rise, move-ins fall.

This relationship didn’t exist in 2008 because liquidity had vanished and credit was frozen. Today, liquidity is still flowing - which means small interest rate moves ripple instantly through the entire system.

Even a small decline in rates can trigger an enormous surge in housing activity, and by extension, self storage demand.

The Difference This Time Around

There are critical differences between now and 2008 - but for storage investors, those differences make this opportunity even more powerful.

-

Liquidity exists. After 2008, even with zero interest rates, people couldn’t borrow. Today, banks are lending selectively, but the system isn’t broken.

-

Consumers are solvent. Homeowners have equity, savings, and historically low locked-in mortgage rates.

-

Development has stopped. New supply has cratered, and it takes three years for new projects to hit the market. That means when demand rebounds, it’ll be met with scarcity.

-

Institutional players are distracted. Big REITs are holding off, waiting for clarity. That leaves space for private investors and operators - exactly where I started.

The result?

We’re entering a compressed window of opportunity where high-quality assets can be bought for less than they can be built - and held through a period of supply contraction and demand recovery.

That’s how generational wealth is created.

Rebuilding the Playbook

In 2008, our playbook was simple:

-

Buy assets with strong fundamentals.

-

Focus on operational improvement.

-

Hold through recovery.

-

Refinance when valuations expand.

That strategy turned modest properties into multi-million-dollar exits.

And today, we’re doing the exact same thing - but with more experience, better data, and a stronger platform.

We’re calling it our Heritage Fund, because it’s designed to build legacy wealth, both for our investors and our families.

My partner and I are investing over $10 million of our own capital into these acquisitions. We’re not talking about syndicating for quick flips. We’re talking about long-term ownership and generational wealth creation.

We’ve spent the last year hiring, scaling our technology stack, and building an operations team capable of managing rapid growth - because we’re preparing to buy a lot.

Over the next six months, we plan to acquire as much quality storage real estate as possible while prices remain disconnected from reality.

This is the window.

What You Can Do (Even Without Millions)

You don’t need to be an institutional investor to take advantage of this moment.

In fact, the biggest opportunities are often in small markets with small facilities, the exact places where big players don’t bother to look.

That’s where I started. Small towns. Modest properties. Low competition.

Today, those assets are seeing the largest price drops in the country - sometimes 40% to 50% below their 2021 valuations.

For new investors, that’s gold.

You can:

-

Work directly with owners who are struggling or ready to retire.

-

Structure seller-financed deals.

-

Put a little more down to bridge higher interest costs.

-

Focus on intrinsic yield - what the property earns - not what it could be worth tomorrow.

The secret isn’t timing the market perfectly. It’s buying right and holding through.

Remember: You can’t change your purchase price once you close. That basis becomes your foundation for wealth.

Why I’m So Confident Right Now

I don’t make decisions based on hype or emotion. I make them based on data and experience.

And all the signals - the slowdown in construction, the stabilization of rents, the slight easing of mortgage rates, the uptick in transaction volume - are aligning perfectly with the early stages of the last cycle.

The fear you’re feeling in the market right now? That’s the same fear I felt in 2008 - right before everything changed.

When everyone else was sitting on the sidelines, we were buying.

And that single decision didn’t just create income. It created freedom - for my family, my partners, and countless investors who came along with us.

That’s why I’m doubling down now.

The Window Won’t Stay Open Forever

Cycles like this don’t come around often.

It’s been more than 15 years since we’ve seen this kind of alignment: low liquidity, halted development, compressed values, and rising fear.

But as always, fear precedes opportunity.

Soon, rates will ease, housing will pick up, and the storage market will tighten again. When that happens, the assets you could have bought today for $4 million will be trading for $7 million (or more).

And everyone will say, “I wish I would have bought back then.”

Don’t be that person.

Whether you’re looking to invest alongside us or start your own small acquisition journey, the time to act is now.

This isn’t financial advice - it’s just the truth of market cycles. You either participate, or you watch others build generational wealth while you wait for certainty that never comes.

My Promise

When I was in the hospital years ago, I made myself a promise: if I got out, I’d spend the rest of my career teaching others what I’ve learned - sharing the playbook openly, not gatekeeping the knowledge that changed my life.

That’s why I write these newsletters, record podcasts, post data breakdowns, and publish books.

If you’re serious about building long-term wealth through storage, whether you’re buying your first facility or your fiftieth, now is the time to learn, act, and execute.

Because 15 years from now, you’ll look back on this moment the same way I look back on 2008 - as the turning point.

Thanks for reading and for being part of this journey with me. If you want to learn more, be sure to check out the full video on Youtube here.

Stay smart, stay strategic, and above all: stay in the game.

Talk soon,

AJ