Analyzing the Self-Storage Industry and Building Revenue

Aug 04, 2023Investing in self-storage can be a lucrative business venture, but it's important to understand what you’re getting yourself into in order to be successful. Being informed through correct market analyses can give you the edge you need to succeed.

Today, we'll walk through the three critical steps of market analysis for self-storage investing:

- Understanding the Market

- Understanding the Industry

- Understanding Utilization

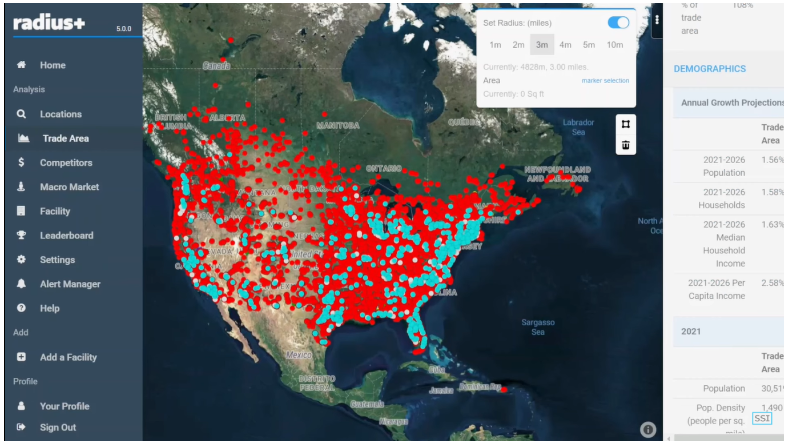

We'll also take a look at a tool called Radius Plus, which can be a powerful tool for analyzing self-storage markets.

Exploring Self-Storage Markets with Radius Plus and Groundwork

Let’s begin by discussing the Radius Plus tool. This tool specializes in aggregating self-storage data. With this tool, we can examine specific markets and delve into individual self-storage facilities within those markets. By analyzing the data, we gain valuable insights into the industry. It's crucial to understand that these tools can be incredibly powerful at providing a wealth of information.

However, it's essential to use them correctly. It's worth noting that not all information is available within the tool, so it has its limitations. Ultimately, nothing surpasses the effectiveness of combining on-the-ground work with the assistance of technology.

The 3 Critical Steps in Analyzing Self-Storage Markets

Now, let’s dive into the 3 steps critical to analyzing self-storage markets:

- The Market: The first step involves understanding the current state of the market. Is the market growing or shrinking? Are the population and incomes increasing or decreasing? By examining these factors, we can gain insights into the market's dynamics.

- The Industry: The second step focuses on the storage industry itself. How many storage facilities are operating in the market? What trends or developments are occurring within the industry? This assessment helps us gauge the overall landscape and competitiveness of the storage sector.

- Utilization: The third step entails examining how customers are utilizing the industry or assets within the market. Understanding customer behaviors, preferences, and demands provides a comprehensive view of market demand. This evaluation brings all the pieces together and enables a thorough analysis of self-storage.

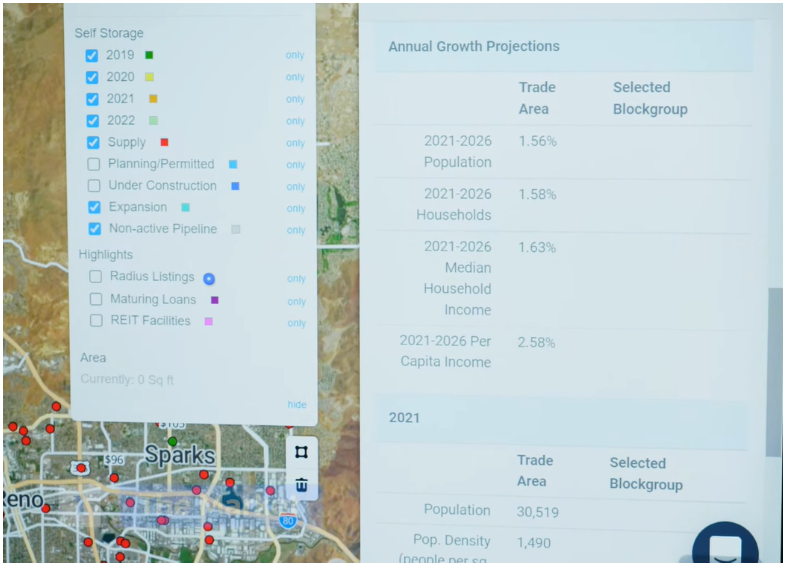

Understanding the Market

To accurately assess demand, the initial step is to analyze the overall market. It is essential to grasp the prevailing trends and understand the factors contributing to market success. Additionally, it is crucial to evaluate the associated risks and examine how these aspects are reflected in the data and statistics generated by the market.

Let me provide you with an example: I have already made investments in Reno, which has a charming sub-market or neighborhood that has caught my attention. I wholeheartedly believe in the broader concept of this market and the developments taking place in Reno. The city is experiencing a surge in growth as people, seeking respite from the increasing costs of living in California, are relocating there. Moreover, businesses are capitalizing on Nevada's favorable tax structure and using Reno as a base to cater to California, resulting in a flourishing and revitalized city.

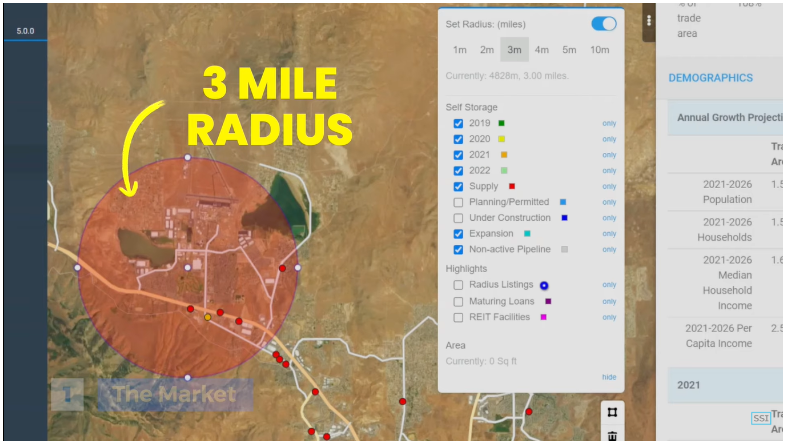

When delving into the micro or sub-market that I am interested in, it's important to remember that self-storage operates within a three-mile radius.

In this specific context, we are focusing on a compact area within the larger market. For more rural locations, this radius might expand, while for urban settings, it could contract. We are primarily concerned with population and population density within this three-mile range.

Within this scope, I am comfortable examining growth projections. Currently, we observe a population growth rate of 1.5 percent, which is quite promising. Additionally, the projected income growth stands at a remarkable 2.58 percent. These figures indicate that the population is increasing, incomes are rising, and people are utilizing the resources and services offered within this market. This upward trend in population and income growth signifies a growing demand.

Understanding the Industry

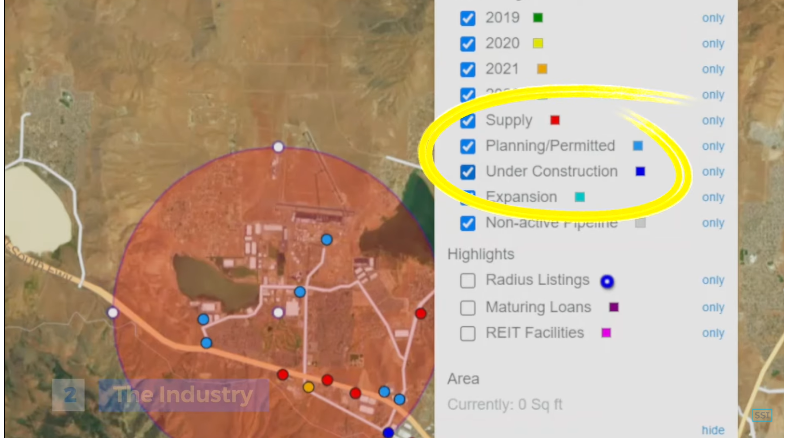

Another crucial aspect to analyze is the industry itself. This includes looking at existing storage facilities, competitors, and operators within the market. Understanding the industry requires examining the current state of affairs, the location of facilities, and identifying key players. Once we have assessed the overall market and determined the favorable population and income growth, we can zoom in and focus on individual self-storage facilities within our target market.

When evaluating these facilities, we consider factors such as their longevity in the market and their size. Additionally, placement or location is crucial to assess. By observing the distribution of storage facilities, we can identify areas where there may be a shortage or potential for growth. Therefore, closely examining the location of these facilities becomes significant.

It is important to note that our analysis should not solely rely on existing assets. Looking at the current state can sometimes present a distorted picture. For a more comprehensive understanding, we need to consider upcoming storage facilities that are either in the planning stage or under construction. This helps us get a more robust idea of what we’re dealing with.

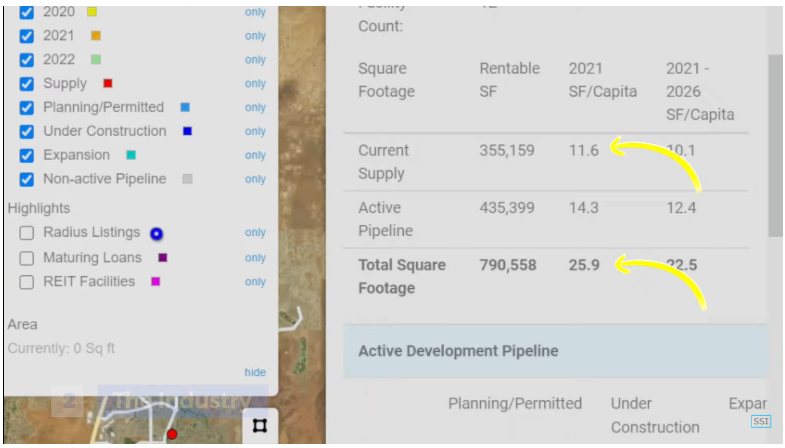

In our three-mile radius, we have observed a significant increase in the number of storage facilities in the pipeline. These new facilities have nearly doubled the existing number, and they have covered areas where no storage facilities previously existed. When we evaluate the impact of these upcoming facilities, we find that the storage capacity per capita increases from 11 square feet to 25.9 square feet.

This metric represents the amount of rentable storage space available per person, taking into account both the existing facilities and the projected population growth. Doubling the storage capacity per person raises questions about the sustainability of such a substantial increase in the market.

Therefore, it is essential to assess whether the market can effectively absorb and sustain this influx of storage facilities within the three-mile radius.

Understanding Utilization

The third aspect to consider is utilization, which ties everything together. Let's examine how customers are utilizing the storage assets within this market. We have already assessed the rising market trends, including increasing incomes and population. Now, we will focus on analyzing the competition and the utilization of existing storage facilities.

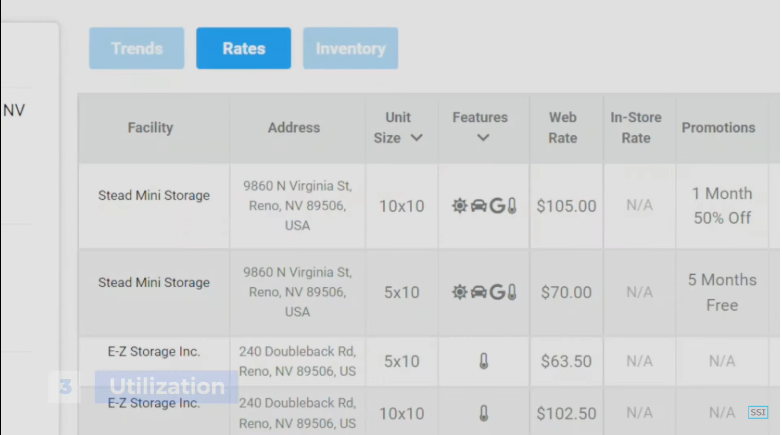

To evaluate the utilization, I will analyze the competition and assess several key factors. Firstly, I will examine the rates charged by competing facilities. This helps determine whether they are sophisticated operators and gives insights into market demand. Another crucial aspect is occupancy rates. Basically, we ask ourselves: Are there enough customers to sustain the market?

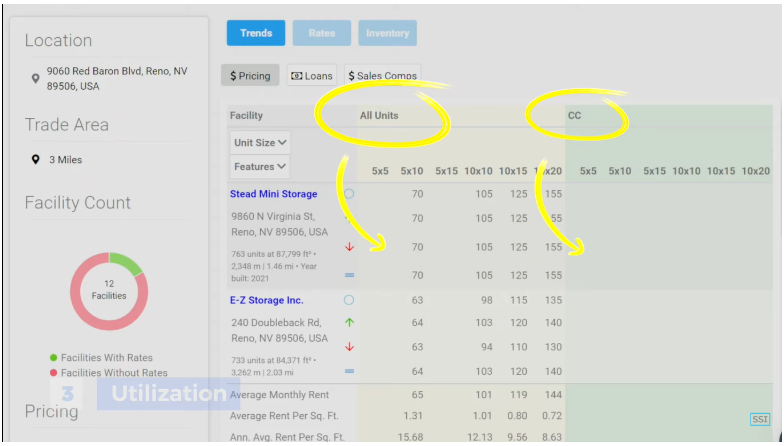

Upon closer inspection, a significant gap becomes evident in this market: there are no climate-controlled units within the three-mile radius. This observation indicates a potential demand for climate-controlled storage.

Next, I will analyze individual storage assets and their unit offerings. By examining the pricing trends, I can understand the range of unit sizes within these facilities. Additionally, I will assess the aggregate data, considering the total square footage and revenue generated. This information helps determine the average rental rates per square foot annually and monthly. It is also worth exploring any special offers or discounts they may be running and which unit sizes are included. These details provide insights into potential variations in demand across different unit sizes.

However, due to the limited number of storage facilities in this market, it becomes challenging to fully understand and interpret this feature. Nevertheless, what we are looking for is the range of rates charged by these facilities. If all the storage facilities fall within a similar pricing range without significant outliers, it suggests that they are generally aligned in terms of their pricing strategies.

Analyzing utilization assists in comprehending how customers are utilizing the available storage assets and helps identify any gaps or opportunities in the market.

Analyzing Storage Market Trends: Rates, Spreads, and Utilization

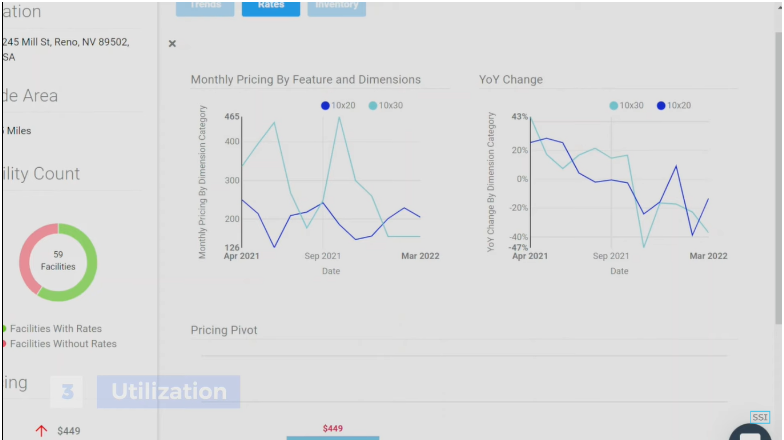

When examining a larger market with a greater number of storage facilities beyond the three-mile radius, we can analyze monthly prices based on features or dimensions and track year-over-year changes in rates. The purpose of this analysis is to identify overall trends. However, it is important to be cautious when interpreting the data, as markets like Reno and other northern markets can exhibit cyclical patterns.

Rates may decrease during slower months but bounce back during peak periods. Therefore, it's crucial to consider the overall timeframe and assess whether rates recover after declining.

The primary goal in studying rates within a market, whether acquiring or constructing storage facilities, is to understand the spread. This refers to the range between the highest and lowest rates and the factors contributing to this variation. Is the spread due to superior operators, favorable locations, or unique offerings? For example, a significant spread of $65 to $329 like the one in the image below, indicates substantial variation. Understanding this spread helps determine the pricing strategy for the acquired asset or area.

By analyzing rates and spreads, we gain insights into the utilization patterns and demands of customers within these storage assets. We can identify if certain units experience higher demand and generate greater revenues. This information guides pricing decisions and provides an understanding of overall demand for different types of units.

While this data is valuable, it does not provide a complete picture of utilization. The best way to assess utilization is through on-the-ground investigation. This is what we often refer to as “performing our due diligence.” This involves secret shopping, visiting the facilities, evaluating their quality and condition, engaging with managers, and exploring their online presence. By conducting these observations, we can gather information on occupancy rates, prices, operational efficiency, customer demand, and popular unit types. This hands-on approach allows us to gain a comprehensive understanding of how inventory is being utilized in the market.

In summary, analyzing rates, spreads, and conducting on-the-ground assessments are essential steps to comprehend utilization and demand within the storage market.

Analyzing Market Potential: Is it a Deal or No Deal?

The question at hand is: "Deal or No Deal?" Firstly, when we examine the radius and assess the market, there are certain aspects that I find favorable. The population and income in this market are both growing, indicating a healthy market environment. This is something we appreciate.

Taking a closer look at the existing storage facilities, one positive aspect stands out: a significant portion of the city seems to be completely overlooked by these facilities. However, what didn't sit well with me were the rates charged by the current storage facilities. They appeared to be quite similar across the board, lacking significant variation. This raised questions in my mind. Are they simply being lazy? Is there no one outperforming the rest? It made it difficult for me to gauge potential revenues and determine where we should price our services within this market. While not a deal breaker, it was certainly concerning.

Another factor that raised red flags for me was the new inventory. The square footage per capita ranged from 11 to 25.7 square feet. I am hesitant to invest in a storage facility that is effectively doubling the square footage per capita in its market. At such a high percentage increase, I'm uncertain whether the market can handle it or not. This, for me, was a deal breaker for both building and acquiring. If I were to acquire a high-priced asset in a market that is being flooded with storage facilities, I would need to make significant adjustments to occupancies and revenues to compensate for the saturation.

While Radius Plus is a useful tool for market analysis, it's important to remember that it doesn't provide all the information. To truly understand what makes a good market, which ones are successful, and how to find them, one must be on the ground and observe firsthand what's happening within that market.

Conclusion

Self-storage investing can be a lucrative business, but it's important to get your market analysis right in order to succeed. By understanding the market, understanding the industry, and understanding utilization, you can paint a picture of market demand and make informed decisions about where to invest. Additionally, tools like Radius Plus can be powerful tools for analyzing self-storage markets, but it's important to use them properly and remember that nothing is better than on-the-ground work when it's paired with technology.