Mastering Underwriting: The Key to Successful Self-Storage Investments

Apr 06, 2023Investing in self-storage can be a reliable way to diversify your portfolio and achieve financial independence, as the industry generates $41.2 billion in revenue annually with an annual growth rate of 3.3%. My personal experience shows self-storage investing to be a resilient asset class even during economic downturns.

With that said, when considering investments, underwriting is critical and this involves a three-legged approach that involves market and demographics research, storage market, and determining the value of the property.

Please note that everything we talk about here is purely informational, and you should always seek professional advice from attorneys and CPAs to do your due diligence before making any investment decisions.

The Three-Legged Approach to Underwriting

Market and Demographics:

- Research the market and demographics of the asset being considered, including competitors, supply and demand, and other relevant factors that could affect the property's value.

Storage Market:

- Take into account various factors, such as occupancy rates, competition, and overall market competition. It is essential to determine who the competitors are, what they provide, and what goods are available in the market.

Value:

- Determine the worth of the property by considering factors such as location, age, and condition to determine the purchase price and expected returns.

Market and Demographics: Understanding the Basics

As someone who has worked in real estate for a while, I've learned that understanding the market and demographics is crucial for finding good deals. Let's dive into the basics of what to look for.

Factors to Consider when Analyzing a Real Estate Market

When analyzing a real estate market, there are several factors to consider that can impact the profitability of your investment. Here are some important points to keep in mind:

Population Growth and Density Regulations

- Check for statistics on population growth to determine the demand for housing in the area.

- Look for regulations on population density that can affect how much you can build and the profitability of your investment.

Sources of Employment in the Area

- Determine if there is a diverse range of industries or if the market is heavily reliant on just one or two.

- Assess how this can impact the stability of the market and the demand for housing.

Identify Problems in the Market

- Look for employers struggling or significant economic downturns, and issues with crime rates or other factors that could impact demand for housing.

- Identifying these problems can help you avoid investing in a market that may be on the decline.

Income Levels and Wealth Distribution

- Consider the income levels and wealth distribution in the market.

- Rising incomes and wealth levels can indicate a growing market with strong demand, while falling incomes can be a sign of trouble.

- Look at income statistics over time to see if the market is on an upward or downward trend.

By considering these factors, you can make informed decisions when investing in real estate and increase your chances of success in the market.

Understanding the Self-Storage Market

Understanding the self-storage market is crucial for real estate investors. Key indicators to look at include occupancy rates, competitor analysis, and product offerings. Overbuilding in the market can lead to decreased rates and income, making it important to carefully consider the competition.

In addition to market analysis, location is a critical factor in determining the potential success of a self-storage investment. Prime locations that attract customers and drive demand are essential for maximizing profits. Overall, investors must carefully analyze both the market and location to make informed investment decisions in the self-storage industry.

Understanding the Makeup of Revenue and Expenses

When it comes to evaluating the value of an asset, revenue and expenses play a crucial role. However, it's important to look beyond the surface level and dive into the individual revenue lines and expenses to fully understand the makeup of them. This is especially important when looking at buying facilities in third-tier markets and smaller deals.

Be aware that expenses can have different meanings for different people, so it's important to clarify what expenses are included in a self-storage facility purchase. Also, remember that taxes are based on the property's tax basis, not the purchase price, which can significantly impact the net profit of the investment.

The Importance of Capital Expenditures

Capital expenditures, or CapEx, is another important factor to consider when evaluating the value of an asset. It's crucial to look at any necessary work that the asset may need to function day-to-day and factor that into the purchase price. For example, if an asset generates $100,000 in income but needs $300,000 in work, the true cost of the asset would be $1.3 million, not just $1 million. It's important to look beyond the surface level and fully evaluate all aspects of the asset.

Understanding Storage Valuations

When it comes to storage valuations, there are many dimensions that are included in the valuation process, and each of them is crucial. It's essential to understand all of them, as they can offset one another. As we move to financial valuations, considerations for past, present, and future become very important.

Past, Present, and Future Considerations

It’s important to remember that value and price are not the same thing, and this cannot be stressed enough. Prices refer to what you pay, while value refers to what you get in the form of income. We have to understand the intrinsic and extrinsic values of assets. Extrinsic values change based on things that are not predicated on intrinsic value, which can work for or against you. Currently, extrinsic values are lowering, meaning prices are dropping, even though the intrinsic value has not changed.

Acquiring Assets: Window of Opportunity

For the last 10 years, the intrinsic value for many assets didn't change, but extrinsic value increased due to cap rate compression. This trend is not favorable, and we are now in a window of time where extrinsic values are lowering, making it a good time to acquire assets. As a buyer, this is a fun time to invest in the market.

Understanding storage valuations and the intrinsic and extrinsic values of assets is crucial when it comes to investing in storage facilities. It's essential to consider past, present, and future factors to determine the best course of action. With extrinsic values lowering, it's a good time to acquire assets and invest in the market.

The Importance of Money on the Table and Rate Runway

As a real estate investor, I have come across many valuation concepts, but the two that stand out the most are money on the table and rate runway. Money on the table refers to the spread between the current value of a property and its potential value, without any changes in the market. This is the measurable value that I focus on when looking at a property's potential. Rate runway, on the other hand, refers to the amount of time it will take for the property to reach its full potential value.

Money on the Table

Measuring value is crucial when evaluating a property's potential. I look at the amount of money I can potentially make by taking action and improving the property. This is where money on the table comes in handy. It's a measurable value that allows me to outline exactly how much money can be made by fixing and taking the value from an underperforming asset.

When it comes to valuing properties, I always start with the current value. This is what the property is worth in its current state, without any changes or improvements. From there, I look at the potential for improvement, and I calculate the money on the table and the rate runway. This helps me to determine whether the property is a good investment, and what price I should be willing to pay for it.

Understanding Rate Runway

Understanding the concept of rate runway is essential to making informed investment decisions. Here are some key points to remember:

- Rate runway is a crucial metric for real estate investors to gauge the potential future movement of interest rates.

- It measures replacement cost and indicates whether the rates in the market are tapped out or will continue to rise.

- If rental rates are not enough to cover the cost of the asset, there may be little to no rate runway.

- In such a market, rental rates are unlikely to rise, making it difficult for investors to recoup their investment.

- On the other hand, if there is a significant rate runway, rental rates may rise, increasing the value of the asset and generating higher returns for investors.

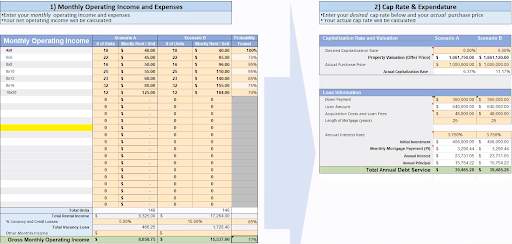

The One-Pager Analyzer

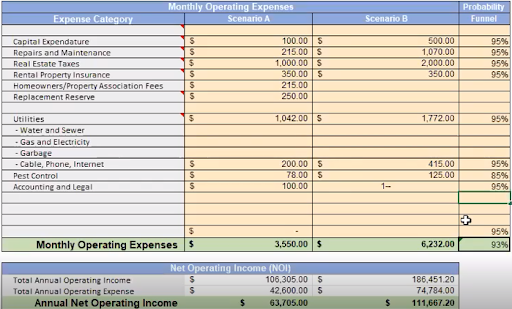

To simplify the process of analyzing real estate investments, I’m using a one-pager analyzer as seen in the image below, that includes all the necessary financial information, including the purchase price, rental revenue, and potential improvements. By using this tool, investors can quickly assess the viability of a potential investment and make informed decisions about whether to move forward.

Note that this is a real deal with actual numbers. We found this deal off-market and have been discussing it with people in our group. The deal includes operating income and expenses, individual products, and the amount they are currently charging. From this, we can determine the gross income, as well as the monthly operating expenses. It is essential to understand the details of the deal to determine its viability.

Physical vs. Economic Occupancy

One important concept to consider when analyzing a deal is physical vs. economic occupancy. Physical occupancy simply means how many doors are occupied, while economic occupancy refers to the actual revenue generated from those doors. For instance, if a facility has 100 doors, and all of them are occupied, the physical occupancy is 100%. However, if some tenants are paying discounted rent, the economic occupancy will be lower than the physical occupancy.

Understanding these two concepts is crucial in determining the actual profitability of a deal. It is not enough to look at the number of doors occupied. Instead, one must consider the amount of revenue generated by those doors. By understanding these concepts and using the deal analyzer, one can make informed decisions and maximize profits in the real estate industry.

Analyzing the Real Estate Market for Profit

When it comes to real estate investing, understanding the market is key. In order to make informed decisions and maximize profits, you need to have a clear understanding of the current state of the market, as well as the potential risks and opportunities that lie ahead. In this section, I'll walk you through the process of analyzing the real estate market, using real-world examples and data to help you make smart investment decisions.

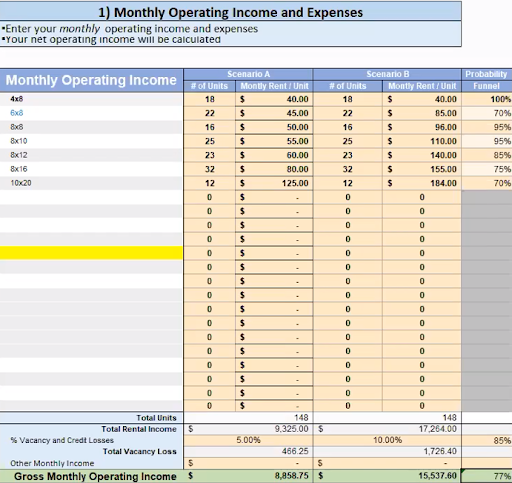

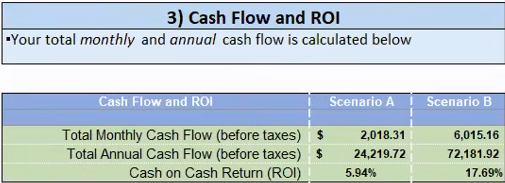

Scenario A: Analyzing the Cap Rate

Let's start with scenario A. Here, we're trying to understand the offering price and cap rate of a property. We input the loan information, including an annual interest rate of 3.75%, and then look at the annual debt service payments. This information is critical in understanding the overall profitability of the property. By analyzing the cap rate, we can determine whether or not the property is a good investment opportunity.

Scenario B: Analyzing Market Rates and Probability

In scenario B, we take a deeper dive into the market rates and analyze the probability of achieving those rates. We look at the same assets within the same exact area, and they're like-minded and the products are the same. By comparing the prices of similar assets, we can get a better understanding of what the property is worth and what we can expect to earn from it.

Probability Funnel: Adjusting Expectations

When you are in the process of underwriting, it's important to accurately assess the potential profitability of a property. One way to do this is by using a probability funnel to adjust expectations based on factors such as unit availability and overall demand. Here are some key points to keep in mind:

- A probability funnel is a confidence factor that you assign to different aspects of your investment.

- It helps to check your biases and assumptions and ensure you're making informed investment decisions.

- For example, you might assign a high probability to the rental income you expect to generate, but a lower probability to the expenses you'll incur.

- To use the probability funnel, assign probabilities to different outcomes based on how confident you are about each one.

- This will help you set realistic expectations for your returns and make smarter investment decisions.

Using the Probability Funnel in Real Estate Investing

Let's say you're looking at a property that you think will generate $9,000 to $17,000 in rental income, but you know that there will be some vacancy loss. You might assign a 10% probability to that loss, meaning that you're 90% confident you'll be able to achieve that rental income. You can do the same thing with your expenses, assigning probabilities based on how certain you are about each line item.

By using the probability funnel, you can stay objective and realistic about your investment. You won't be tempted to fudge the numbers to make a deal look better than it is, and you'll have a clear idea of what you need to achieve in order to make your investment successful.

Understanding Cap Rates and Expenditures for Real Estate Investment

As a real estate investor, one of the most important factors to consider is the cap rate, which is the ratio of the net operating income of a property to its purchase price. In this section, I will discuss how cap rates and expenditures impact real estate investments, and how to determine if a property is a good deal.

Impact of Expenditures on Real Estate Investments

When investing in real estate, it is important to consider the expenditures associated with the property. For instance, a well-managed facility that does not require much attention from the owner or an employee can be more profitable than a facility that requires constant management. When calculating the net operating income of a property, it is crucial to factor in all associated expenses and assess if they are worth the investment.

Calculating the Cap Rate and Determining a Good Deal

To determine if a property is a good deal, investors can use the cap rate formula. Cap rate is calculated by dividing the net operating income of the property by the purchase price. A higher cap rate indicates a better investment opportunity. Investors should also factor in potential revenue increases, such as rental rate increases, to determine if the investment will yield a good return.

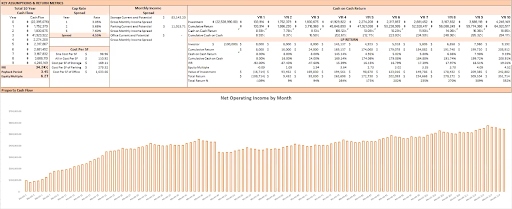

Using an Advanced Modeler for Financial Analysis

When it comes to analyzing financial data, there are a lot of tools out there. But not all of them are created equal. Our company has been developing our own advanced modeler for the past 20 years, and it's built directly from our operations. This means that it's tailored specifically to our needs, and it's not filled with unnecessary fluff that we don't need.

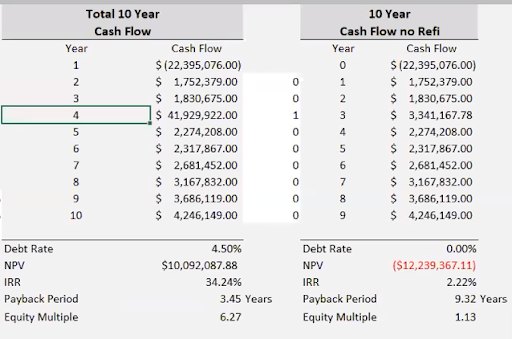

Snapshot Analysis

One of the first things we do with our advanced modeler is take a snapshot of our LP returns and different scenarios and how it may work. Our goal is to get over 120% by year four, and we're very focused on our 10-year width and without. After three or four years, we standardize things because things can get unpredictable after that point. The images below provides a visual representation.

The box below holds significant importance as it's where my professional fate lies. Its contents are crucial to my business decisions, and I focus on several key factors, including the NPV, internal rate of return, payback, and equity multiple. These metrics were specifically assessed for our initial fund.

Maximizing Returns in Real Estate Investment: Why Predictability is Key

Real estate investing is a popular way to grow your wealth, but it requires careful consideration and analysis to maximize returns. As an experienced real estate investor, I have learned that predictability is key to successful investments. In this section, I will discuss why we should avoid making speculative assumptions and instead rely on known, set ways of assessing investment opportunities.

Avoid Speculative Assumptions

When investing in real estate, it can be tempting to make assumptions about future market conditions and try to predict returns based on those assumptions. However, as the saying goes, "anybody that says that they do [know what's going to happen in the future] is smoking crack." Making up numbers and relying on speculative assumptions is not a sound investment strategy and can lead to disappointment and lost opportunities.

Predictability Leads to Better Investment Decisions

Predictability leads to better investment decisions because it provides a clear path forward. Instead of hoping and praying that the market will work in our favor, we can rely on fixed bank refinance rates to determine returns. This allows us to make informed decisions based on measurable data, rather than relying on speculation and hope.

Conclusion

I have found that this industry offers a unique opportunity to compound your money while reducing risk. This strategy has proven to be successful for me, especially during the 2008 recession when other investment options were failing. The key is to approach it strategically and avoid assuming that self-storage is recession-proof.

Statistics show that the demand for self-storage has been steadily increasing over the years, with the industry expected to grow at a CAGR of 7.3% from 2021 to 2028. However, it's essential to understand that not all self-storage investments are created equal. It's crucial to do your research and invest in the right assets to ensure success.

By being open about our information and why we do what we do, we have been able to flourish and even buy deals that we have not seen in years. In fact, we just did a refinancing in 2021, and our next one is in 2029. It's a great feeling to compound your money and not lose it.