$4.4 MILLION On 1 Property in 1 Year [Self Storage Investing Home Run]

Nov 10, 2023Earning over 4.4 million dollars from a single property in just one year – it might sound unbelievably crazy, and I'm genuinely thrilled to delve into the details and discuss this property and how we managed to achieve this.

We're about to embark on an exploration that involves a multitude of numbers. We'll meticulously present and dissect the data, allowing you to understand precisely what transpired with this property, and how we managed to achieve this remarkable feat. This case serves as a perfect example and epitomizes the kind of property I'm particularly drawn to – the ones with immense growth potential. Let's dive in.

Property Overview

First and foremost, this was an off-market deal located on the outskirts of a major market. It involved a family-operated storage facility with approximately 80,000 net rentable square feet, which translates to around 600 storage unit doors. The property was in excellent condition, well-maintained with paved access. However, no significant operational improvements had been made. It was conveniently situated on a main road. The owners were motivated to sell without the hassle, as they were elderly and simply wanted their price to conclude the transaction promptly. The asking price for this property was six million dollars.

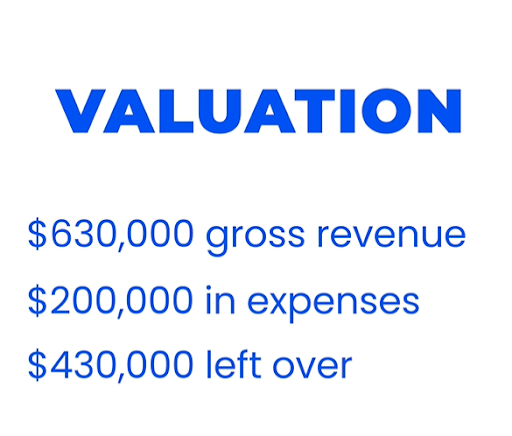

Valuation

When examining the property's existing revenue and expense ratio, it was determined to have a 7% capitalization rate (cap rate). For those unfamiliar with cap rates, they are a common valuation tool used to assess the potential return on investment. In summary, a 7% cap rate indicates the return on investment you can expect.

Breaking down the numbers associated with the six million dollar valuation, the property generated approximately $630,000 in gross revenue, representing its total income. Operating expenses amounted to around $200,000, resulting in a net income of $430,000.

It's important to note that this net income figure does not account for any outstanding debts, which will be discussed shortly. For the purpose of this valuation, we are excluding any outstanding debt. Therefore, the property's net income stands at $430,000.

Now, let's consider what must be done to the property to ensure it can function as desired and provide a high-quality offering.

Capital Expenditures

When we talk about revitalizing or updating a facility, we refer to what's known as capital expenditures. Capital expenditures are the investments we make in the facility to bring it up to a higher quality standard, even though it may not appear entirely brand new. Our goal is to achieve the level of quality necessary to command the desired rental prices for the units and ensure that the deal is financially sound.

Now, you might wonder whether this is indeed a good deal. Well, determining if it's a good deal can be a complex question because what constitutes a good deal can vary from person to person. In this particular case, we are implementing a value-add strategy, meaning we are purchasing the property with the intention of enhancing its value, which, in turn, increases its revenue potential.

We primarily achieve this through two means: capital expenditures and operational improvements. Capital expenditures involve fixing or upgrading elements of the facility that are in disrepair. This might include renovating certain parts of the buildings, installing new doors, updating security gates, and addressing various other aspects. In the case of this facility, the capital expenditure requirements were relatively low.

Access Points

To enhance the functionality of this facility, we allocated approximately sixty thousand dollars for capital expenditures. The primary reason for this investment was related to access points. The facility had its gate situated outside while the office was located inside. This setup created challenges for customer access, a common issue in the self-storage industry. In fact, we frequently encounter this scenario. Currently, we're addressing access points and gate configurations at three other facilities we've acquired, as it's a prevalent concern.

The issue with this arrangement is that it makes it difficult for customers to conveniently park in front of the office, have easy access, and still maintain the security of the facility. Our goal is to provide customers, as well as potential tenants, with a seamless experience.

By relocating the office to an accessible position, we can effectively present the value proposition to customers. The office, staffed with trained personnel and a welcoming, secure, and attractive environment, plays a pivotal role in shaping the perceived value of what customers are acquiring. This investment of around sixty thousand dollars was crucial in optimizing these access points and ensuring a better customer experience.

Now, you might be wondering if we paid the full six million dollars for the property. The answer is, of course, we did not.

Financing

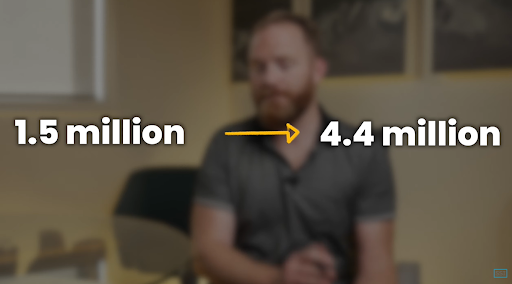

To acquire this property, we initiated the process by making a down payment of 1.5 million dollars. We utilized investors to secure this initial capital. With the 1.5 million dollars down payment, we were able to obtain a loan of 4.5 million dollars.

The advantage we had in this transaction was the presence of a longer contract, which allowed us a generous timeframe to close the deal. This extended period of several months for due diligence gave us the opportunity to thoroughly assess the facility, analyze the market, and gain a comprehensive understanding of various factors before finalizing the purchase. This was particularly advantageous, especially when working with investors, as such extended due diligence periods are not always available, especially in the current real estate climate.

Revenue Potential

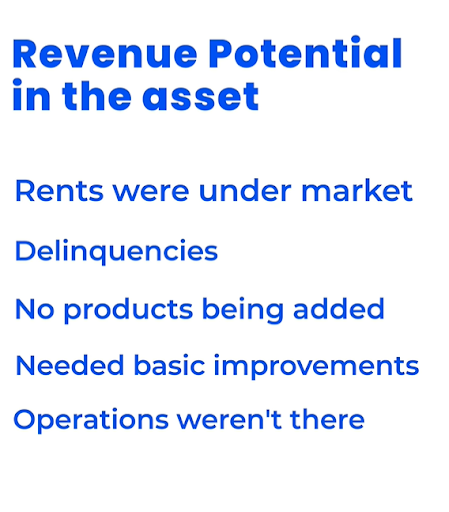

Now, let's address the critical question regarding whether the 6 million dollar investment in this property represents a good deal. To answer that, we need to delve into a fundamental concept that's absolutely crucial: Revenue Potential.

Revenue Potential encompasses the maximum income a property can generate. Is it currently at its peak, or have we fully realized its potential? In the case of this property, it was clear that the revenue potential had not been fully tapped. Rental rates were well below the market average, delinquencies were present, and auxiliary products like insurance and storage boxes needed basic improvements.

Furthermore, the operational aspects were lacking, with somewhat passive management in place. It was a situation where prospective renters could secure a unit if they happened to come by, but there was minimal proactive management. Operationally, it needed significant improvements. One of my preferred strategies in the storage industry is the value-add approach, which emphasizes optimizing operations with minimal capital expenditures. This allows us to enhance revenue without substantial costs, making it a particularly attractive strategy.

Furthermore, the operational aspects were lacking, with somewhat passive management in place. It was a situation where prospective renters could secure a unit if they happened to come by, but there was minimal proactive management. Operationally, it needed significant improvements. One of my preferred strategies in the storage industry is the value-add approach, which emphasizes optimizing operations with minimal capital expenditures. This allows us to enhance revenue without substantial costs, making it a particularly attractive strategy.

With this in mind, we were enthusiastic about the potential of this facility. After acquiring the property, we wasted no time implementing changes. We upgraded the entrance gates, refined our marketing strategies, enhanced the office to improve its value presentation, and recruited well-trained managers. These managers were skilled in sales and upselling, ensuring that when customers visited our storage facility, they received top-notch service. Our goal was to provide customers with an excellent experience, making them more likely to choose us for their storage needs.

We also revamped our marketing efforts, recognizing that a significant portion of self-storage rentals originate from online advertising. We relied heavily on online ads, with over 80% of our tenants coming to us through online platforms, primarily on mobile devices. These online ads were targeted, and we worked with a third-party company to deliver our marketing campaigns.

The results were evident within a year of taking over the property. It's important to note that we didn't undertake any major construction or rebuilding. Instead, we made simple changes like updating the gates and improving the office. These seemingly small adjustments led to remarkable transformations in the property's performance.

Summary

Through our revenue management, improvements, marketing efforts, and enhanced value presentation, coupled with our well-trained staff, we were able to substantially increase our annual gross revenue to $928,000 in just over a year. It's worth noting that when we initially acquired the property, the gross revenue stood at $630,000.

What's particularly significant is that our overall expenses remained consistent with what they were when we made the purchase. This meant that our net income amounted to $728,000, using the same valuation method (a seven-cap) that we employed during the acquisition. Considering that none of the other factors had changed, this brought the property's value to $10.4 million.

As a result, we gained equity of $5.9 million in the property, alongside a net cash flow of $728,000. In essence, we turned our initial $1.5 million investment into $4.4 million in just one year, showcasing the power and potential of the value-add strategy in the self-storage industry. However, it's crucial to acknowledge that while this approach can be highly rewarding, it comes with risks and potential downsides.

One of the challenges we encountered was the need to transition many tenants to higher rental rates. Some of these tenants had never received rate increases before, and the adjustments were substantial, and potentially surprising for them. Therefore, thorough market analysis and understanding the rent ceiling in a given area are essential during due diligence.

We look for opportunities where our current rent levels are below the market ceiling, allowing us to capture the "money on the table" – the difference between our existing rates and the rates of similar-quality facilities in the area. Aligning our rates with the market's standards helps us yield substantial rewards. This strategy resembles a form of arbitrage, where we acquire a facility that is not in line with the rest of the market, align it with market norms, and reap the benefits. It's a potent approach, and among the various strategies in self-storage, it's one of my favorites.

In conclusion, our journey with this property exemplifies the remarkable potential of the value-add strategy in the self-storage industry. By leveraging revenue management, operational enhancements, marketing endeavors, and a focus on customer experience through our well-trained staff, we achieved remarkable results in just over a year.