The Hidden Strategy That Powered Buffett’s $700 Billion Empire

Hey there, I’m actually pumped to be talking about this subject - it’s something (or I guess, someone) I’ve followed for quite a while.

I love talking about business and entrepreneurship strategies - and I’m a big fan of Warren Buffet. I mean, who doesn’t love a guy that is worth billions, but drives a used car because it makes economic sense? That’s a guy I can get behind.

Aside from being incredibly frugal for a multi-billionaire, have you ever wondered what truly sets Warren Buffett apart? While most think it’s just his stock-picking genius, there’s a secret weapon behind his extraordinary success: insurance float.

This little-known strategy has allowed Buffett to access billions in cost-free capital, amplifying his investments and propelling Berkshire Hathaway to a staggering $700+ billion valuation.

So, what exactly is “insurance float”...?

In simple terms, insurance float is the money an insurance company holds between collecting premiums and paying out claims. For Buffett, this means billions of dollars at his disposal - funds he can invest without paying interest. It’s like using someone else’s money for free, and it has supercharged his investment returns for decades.

Unlike traditional loans or debt, float doesn’t come with interest payments or strict repayment schedules. As long as Berkshire’s insurance businesses break even - or better yet, turn a profit - Buffett essentially gains access to a revolving door of capital that compounds over time. This allows him to not only make larger investments but also weather market downturns without the pressure of high-interest liabilities.

How has this transformed Berkshire Hathaway?

-

In 1967, Berkshire's float was just $19 million. By 2022, it had skyrocketed to $164 billion (a nearly 8,000x increase!)

-

This float has consistently represented a significant percentage of Berkshire's book value, giving Buffett a powerful pool of capital to grow his empire.

-

Unlike traditional leverage, Buffett doesn't pay interest on float - making it a free or even profitable form of funding.

-

The steady growth of float has given Buffett the flexibility to make bold acquisitions, from buying entire companies to investing heavily in blue-chip stocks, without relying on costly borrowing.

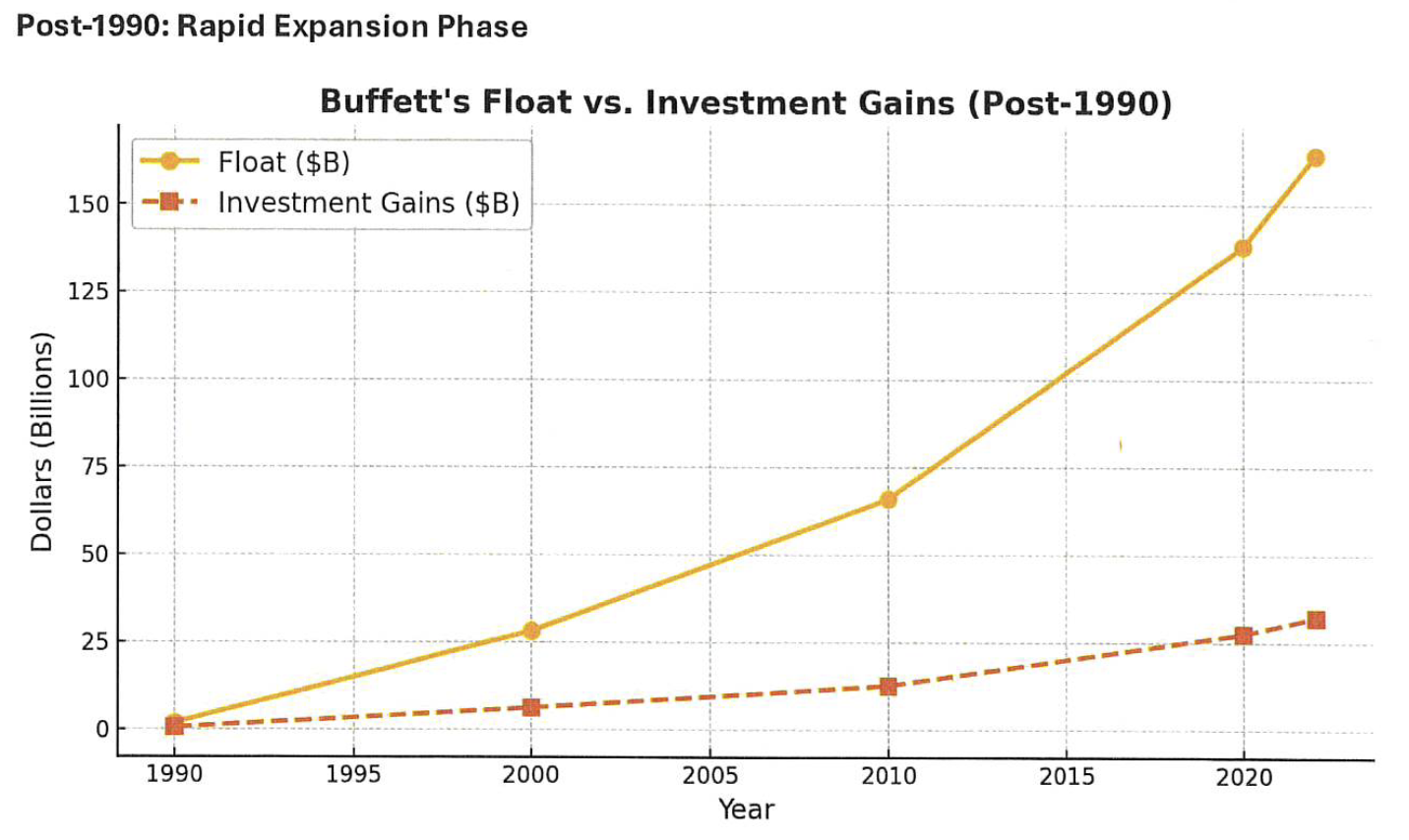

You can really see Buffett’s growth by comparing the below two charts: Pre-1990 and Post-1990.

The chart above illustrates how Buffett’s float and investment gains grew steadily before 1990. During this period, float was increasing at a moderate rate, primarily through the expansion of National Indemnity and smaller insurance holdings.

After 1990, Buffett’s float saw an explosive rate, largely driven by major acquisitions like GEICO (1995) and General Re (1998). The above chart shows the sharp increase in float and how it dramatically accelerated Buffett’s ability to invest more capital.

This transformation in float size is what enabled Buffett to execute some of his best investment decisions, further solidifying his legacy as the Oracle of Omaha.

But that’s not all. Buffett combines this with savvy tax strategies that give him yet another advantage.

Buffett’s Tax Efficiency: The Hidden Edge

Buffett doesn’t just grow his investments. He keeps more of his gains by minimizing taxes. Here’s how:

-

Holding stocks for the long term: Rarely selling means he avoids capital gains taxes.

-

Investing pre-tax dollars: He uses insurance float - essentially pre-tax money - to fund investments.

-

Deferring taxes on unrealized gains: By holding onto winning companies for decades, he lets his wealth compound without interruption.

-

Utilizing deferred tax liabilities: Buffett often invests in businesses where taxes on gains are postponed indefinitely, boosting the compounding effect of his portfolio.

This combination of free capital and strategic tax deferral means Buffett’s money works harder and longer - often compounding at pre-tax rates - a luxury most investors simply don’t have.

Lessons from Buffett: Investing Smarter

I’ve taken inspiration from Buffett's strategies and adapted them to my own business and investment practices. How? I leverage undervalued storage facilities, using non-recourse loans and strategies like forced appreciation to grow wealth while minimizing risk—similar to Buffett’s conservative approach.

How do I apply these strategies?

-

Non-recourse loans: Allows my company to borrow capital without putting personal assets at risk - like how Buffett uses float as “free” money.

-

Forced appreciation: By improving underperforming storage facilities, we boost their value without relying solely on market conditions - similar to Buffett buying undervalued companies and enhancing their operations.

-

Tax efficiency: We use 1031 exchanges to defer taxes when selling properties, collateralizing assets, and leveraging debt to pull money out tax-free - like Buffett’s approach to deferring capital gains taxes.

-

Compounding returns: We focus on long-term growth by reinvesting gains, using cash-out refinancing to reinvest without liquidating assets.

Just like Buffett’s float, we find ways to access and control capital beyond our own, focusing on long-term value creation and cash flow rather than short-term wins.

Why does this matter to you?

While you might not have access to billions in float, adopting Buffett’s principles can still transform your financial future. The key takeaways for your investment strategy include:

-

Think long-term: Wealth grows exponentially over time. Patience pays off!

-

Minimize taxes: Hold investments longer and explore tax-efficient strategies.

-

Leverage your edge: Buffett’s was insurance float, mine was strategic real estate investing. What unique advantage can you leverage?

-

Structure your investments smartly: Consider how debt, collateral, and tax strategies can amplify your growth.

-

Reinvest your gains: Don’t just cash out. Use strategies like refinancing or exchanges to keep your money working for you.

Conclusion

The road to building extraordinary wealth isn’t reserved for the Buffetts of the world. By understanding and applying these proven strategies - leveraging capital efficiently, minimizing taxes, and thinking long-term - you can position yourself for lasting financial success.

Whether you’re investing in stocks, real estate, or your own business, the key is to create a system where your money works harder and grows faster. Start small, stay consistent, and watch the power of compounding transform your future.

Invest smarter, not harder.

Best,

AJ